A2/AS Economics OCR

- Created by: JadeLA

- Created on: 28-05-17 19:59

Economies of Scale

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to size, output, orscale of operation, with cost per unit of output generally decreasing with increasing scale as fixed costs are spread out over more units of output. Economies of scale: financial risk bearing purchasing (accept bulk buying for identification) technical marketing managerial

Competitive Markets

Competitive markets are characterised by:

- Many firms as opposed to a small number

- Low barriers to entry and exit. – Contestable market

- Low profits of incumbent firms

- Relatively low prices.

Fiscal Policy

Fiscal policy involves the government changing the levels of taxation and government spending in order to influence Aggregate Demand (AD) and the level of economic activity.

- AD is the total level of planned expenditure in an economy (AD = C+ I + G + X – M)

The purpose of Fiscal Policy

- Stimulate economic growth in a period of a recession.

- Keep inflation low (UK government has a target of 2%)

- Basically, fiscal policy aims to stabilise economic growth, avoiding a boom and bust economic cycle.

Fiscal Policy: Expansionary

- This involves increasing AD.

- Therefore the government will increase spending (G) and / or cut taxes (T). Lower taxes will increase consumers spending because they have more disposable income (C)

- This will tend worsen the government budget deficit and the government will need to increase borrowing.

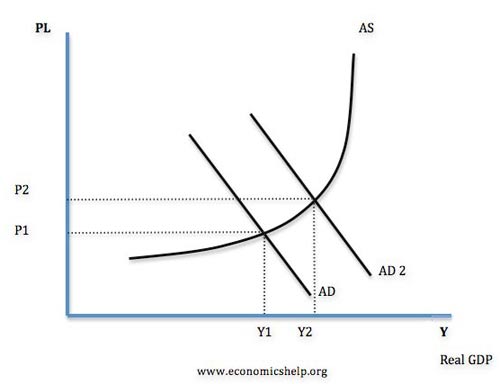

Diagram showing effect of expansionary fiscal policy

Fiscal Policy: Deflationary

- This involves decreasing AD.

- Therefore the government will cut government spending (G) and / or increase taxes. Higher taxes will reduce consumer spending (C)

- Tight fiscal policy will tend to cause an improvement in the government budget deficit.

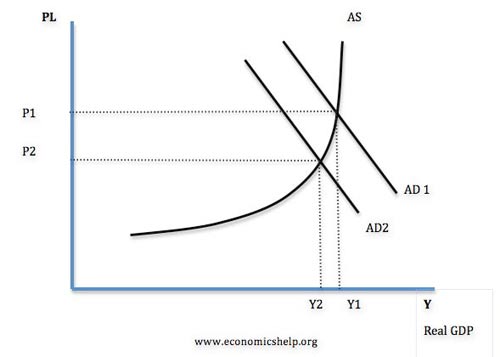

Diagram showing the effect of tight fiscal policy

Fiscal Policy: Key terms

- Fiscal Stance : This refers to whether the government is increasing AD or decreasing AD, e.g. expansionary or tight fiscal policy

- Fine Tuning : This involves maintaining a steady rate of economic growth through using fiscal policy. However this has proved quite difficult to achieve precisely.

- Automatic fiscal stabilisers – If the economy is growing, people will automatically pay more taxes ( VAT and Income tax) and the Government will spend less on unemployment benefits. The increased T and lower G will act as a check on AD. But, in a recession the opposite will occur with tax revenue falling but increased government spending on benefits, this will help increase AD

- Discretionary fiscal stabilisers – This is a deliberate attempt by the government to affect AD and stabilise the economy, e.g. in a boom the government will increase taxes to reduce inflation.

- The multiplier effect. When an increase in injections causes a bigger final increase in Real GDP.

- Injections (J) – This is an increase of expenditure into the circular flow, it includes govt spending(G), Exports (X) and Investment (I)

- Withdrawals (W) – This is leakages from the circular flow This is household income that is not spent on the circular flow. It includes: Net savings (S) + Net Taxes (T) + Net Imports (M)

Fiscal Policy: Criticism

- The government may have poor information about the state of the economy and struggle to have the best information about what the economy needs.

- Time lags. To increase government spending will take time. It could take several months for a government decision to filter through into the economy and actually affect AD. By then it may be too late.

- Crowding out. Some economists argue that expansionary fiscal policy (higher government spending) will not increase AD, because the higher government spending will crowd out the private sector. This is because government have to borrow from the private sector who will then have lower funds for private investment.

- Government spending is inefficient. Free market economists argue that higher government spending will tend to be wasted on inefficient spending projects. Also, it can then be difficult to reduce spending in the future because interest groups put political pressure on maintaining stimulus spending as permanent.

- Higher borrowing costs. Under certain conditions, expansionary fiscal policy can lead to higher bond yields, increasing the cost of debt repayments.

Fiscal Policy: 20marker eval

The success of fiscal policy will DEPEND ON:

- It depends on the size of the multiplier. If the multiplier effect is large, then changes in government spending will have a bigger effect on overall demand.

- It depends on the state of the economy. Fiscal policy is most effective in a deep recession where monetary policy is insufficient to boost demand. In a deep recession (liquidity trap). Higher government spending will not cause crowding out because the private sector saving has increased substantially. See: Liquidity trap and fiscal policy – why fiscal policy is more important during a liquidity trap.

- It depends on other factors in the economy. For example, if the government pursue expansionary fiscal policy, but interest rates rise and the global economy is in a recession, it may be insufficient to boost demand.

- Bond yields. If there is concern over the state of government finances, the government may not be able to borrow to finance fiscal policy. Countries in the Eurozone experienced this problem in the 2008-13 recession.

Globalisation

Globalisation refers to the integration of markets in the global economy, leading to the increased interconnectedness of national economies.

Reasons for growth of globalisation:

- National Economies are becoming more closely integrated with each other. For example the Common Market in the EU, harmonization of Monetary Policy. But also closer integration in America and Africa

- Increase in World Trade, Tariffs and other impediments to world trade have gradually been reduced leading to an increase in world trade.

- The WTO has been instrumental in bringing about a more integrated and interdependent global economy

- Economies tend to move in trade cycles together. A slow down in US growth has an impact on the whole world economy, because of the importance of trade.

- Monetary Policy is linked between the economies, if US cuts its interest rate, this is likely to lead other countries to cut theirs

Globalisation: benefits and costs

Benefits of globalisation:

- Increased trade

- Increased economies of scale enabling lower prices

- Increased competition pushing down prices

- Increased choice of goods, services and opportunities for work

Costs of globalisation:

- Growth of global monopolies with opportunity to exploit consumers

- Environmental costs from increased use of raw materials.

Trade

“Free trade means that countries can import and export goods without any tariff barriers or other non-tariff barriers to trade.

1. The theory of comparative advantage - Free trade enables countries to specialise in those goods where they have a comparative advantage.

2. Reducing tariff barriers leads to trade creation - Trade creation occurs when consumption switches from high-cost producers to low-cost producers.

3. Increased exports - Lower tariffs on UK exports will enable a higher quantity of exports boosting UK jobs and economic growth.

4. Economies of scale - The benefits of economies of scale will ultimately lead to lower prices for consumers and greater efficiency for exporting firms.

5. Increased competition - More incentives to cut costs and increase efficiency. It may prevent domestic monopolies from charging too high prices.

6. Trade is an engine of growth.

Economists of free trade

7. Make use of surplus raw materials - Middle Eastern countries such as Qatar are very rich in reserves of oil, but without trade, there would be not much benefit in having so much oil. Japan, on the other hand, has very few raw materials; without trade, it would have low GDP.

8. Tariffs may encourage inefficiency - If an economy protects its domestic industry by increasing tariffs industries may not have any incentives to cut costs.

Economists

Adam Smith, The Wealth Of Nations (1776) Smith generally supported free trade arguing countries should specialise in their areas of expertise.

David Ricardo On the Principles of Political Economy and Taxation.(1817) Ricardo made case for free trade on basis of comparative advantage. Ricardo tried to show that removal of tariffs would lead to a net welfare gain.

John Maynard Keynes. Keynes was generally free trade and supported the logic of specialisation

Governement intervention in markets

Government intervention is regulatory action taken by government that "interfere" with decisions made by individuals, groups and organisations about social and economic matters to try to correct market failure.

Aim: To improve economic efficiency ny changing the allocation of resources.

Market based policies: The governemnt take action to affect the condition of supply or demand. E.g. offering subsidies, buffer stock or providing better information.

non-market based policies: The government intervenes directly in markets. E.g. Legally enforced regulations.

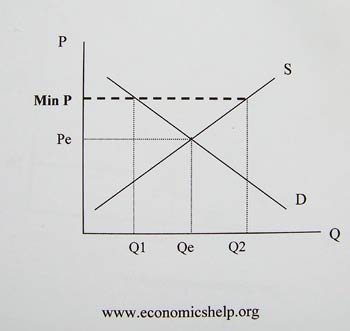

Minimum Price: This involves the government setting a lower limit for prices

Minimum price Diagram

A minimum price will lead to a surplus (Q2 – Q1) to overcome this the govt could

- 1. Buy the surplus and store it

- 2. Increase Demand through advertising

- 3. Reduce Supply through quotas

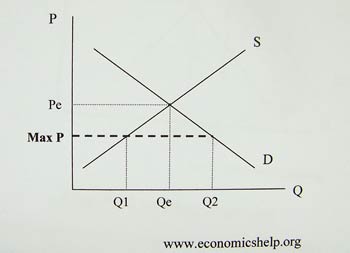

Maximum price diagram

Maximum Price: This involves putting a limit on any increase in price

The Maximum price will be above the equilibrium.

- However the problem of a maximum price is that there will be a shortage Demand is greater that supply.(Q2-Q1)

- This will encourage the operation of black markets.

Therefore the government will have to ration the goods or increase supply

Buffer stock

Buffer stock: scheme is a government plan to stabilise prices in volatile markets. This requires intervention buying and selling.

Buffer stock schemes aim to:

- Stabilise prices

- Ensure supply of food

- Prevent farmers / producers going out of business because of drop in prices.

If there is a surplus one year, the market price would fall. If supply increases to S2, price falls to P1. This is when the government will buy the surplus stocks (Q2-Q1) and store the goods. This reduces supply and keep prices at the target price. If there is a shortage in the next year, the government can sell from its buffer stock to reduce prices and increase market supply.

Buffer Stock: advantages and disadvantages

Advantages of a successful buffer-stock scheme:

- Stable prices help maintain farmers' incomes and improve the incentive to grow legal crops

- Stability enables capital investment in agriculture needed to lift agricultural productivity

- Farming has positive externalities it helps to sustain rural communities

- Stable prices prevent excess prices for consumers – helping consumer welfare

Problems with buffer stock schemes

- Cost of buying excess supply can cause a buffer stock scheme to run out of cash

- A guaranteed minimum price might cause over-production and rising surpluses which has economic and environmental costs

- Setting up a buffer stock scheme also requires a significant amount of start up capital, since money is needed to buy up the product when prices are low.

- There are also high administrative and storage costs to be considered.

Buffer Stock; 20 mark

In theory buffer stock schemes should be profit making, since they buy up stocks of the product when the price is low and sell them onto the market when the price is high. However, they do not often work well in practice. Clearly, perishable items cannot be stored for long periods of time and can therefore be immediately ruled out of buffer stock schemes.

- The success of a buffer stock scheme however ultimately depends on the ability of those managing a scheme to correctly estimate the average price of the product over a period of time. This estimate is the scheme's target price and obviously determines the maximum and minimum price boundaries.

- But if the target price is significantly above the correct average price then the organization will buy more produce than it is selling and it will eventually run out of money. The price of the product will then crash as the excess stocks built up by the organization are dumped onto the market.

- Conversely if the target price is too low then the organization will often find the price rising above the boundary, it will end up selling more than it is buying and will eventually run out of stocks

Summary of Government Intervention

Type of Market Failure

Consequence of Market Failure

Example of Government Intervention

Factor immobility

Structural unemployment

State investment in education and training

Public goods

Failure of market to provide pure public goods, free rider problem

Government funded public goods for collective consumption

Demerit goods

Over consumption of products with negative externalities

Information campaigns, minimum age for consumption

Summary of Government Intervention

Merit goods

Under consumption of products with positive externalities

Subsidies, information on private benefits

Imperfect information

Damaging consequences for consumers from poor choices

Statutory information / labeling

High relative poverty

Low income families suffer social exclusion, negative externalities

Taxation and welfare to redistribute income and wealth

Monopoly power in a market

Higher prices for consumers causes loss of allocative efficiency

Competition policy, measures to encourage new firms into a market

Government intervention: Evaluating effectiveness

1. Value Judgements: Many people want a particular intervention because of their own vested interests.

2. Changing prices to change incentive and behaviour: PED has a big effect on the effectivenes of policy.

3. Social science: The effects of intervention cannot be forecast with great accuracy - people's behaviour is subject to change.

4. Combinations of policies: One single intervention is unlikely to produce a solution to deep-rooted problems - build a variet of policy options into your discussion.

5. The power of markets: Market forces can be powerful in finding profitable solutions to problems.

6. The 'law of unintended consequences': Intervention does not always work in the way in which it was intended or the way in which economic theory predicts it should.

Government intervention: Taxes

Indirect Tax: A tax imposed by the Gov. that increases the supply costs faced by producers. (The virticle difference between the two supply curves, less can be supplied at the price level.... movement along the demand curve).

E.g. Specific tax (tax per unit), Ad valorem tax (percentage tax), VAT.

Government intervention: Subsidies

Subsidy: Any form of governemnt support - financial or otherwise - offered to producers and (occasionally) consumers. (supply curve shifts to the right... increase Q and decrease P).

Justification for subsidies for producers:

1. Help poor families

2. Encourage output and investment in fledging sectors

3. Protect jobs in loss-making industries

4. Make health care more accessible

5. Reduce cost of training & employing workers

6. Achieve a more equitable income distribution

7. Reduce some external costs of transport

8. Encourage cultural services

Inflation and Deflation

Inflation and deflation arise from changes in either the demand side or supply side of the macro-economy.

Demand pull inflation

Demand pull inflation usually occurs when there is an increase in aggregate monetary demand caused by an increase in one or more of the components of aggregate demand (AD), but where aggregate supply (AS) is slow to adjust.

Inflation: Causes of Demand Pull

The commonest causes are demand shocks, such as:

-

Earnings rising above factor productivity.

-

Cheaper credit, following a reduction in interest rates.

-

Excessive public sector borrowing.

-

A housing boom creating equity withdrawal and a positive wealth effect.

-

Changes in the savings ratio.

The savings ratio

The savings ratio indicates the percentage of disposable income which is saved, rather than spent. Sudden changes in the savings ratio are an indicator of future changes in spending and AD, and can be a prelude to inflation or deflation.

A rise in the savings ratio indicates a decline in consumer confidence, whereas a fall in the savings ratio indicates a rise in confidence and spending, which can trigger an increase in the price level.

Inflation: Cost push

Cost-push inflation occurs when an economy experiences a negative cost shock.

An increase in costs causes the aggregate supply curve to shift upward and to the left, resulting in a rise in the price level, and a contraction of aggregate demand.

Inflation: Causes of cost push

-

Oil price shocks, caused by wars or decisions by OPEC to restrict output.

-

Increases ingeneral food prices, following a series of poor harvests.

-

Rapidly rising wage costs.

-

A fall in the exchange rate, which increases the price of all imports.

-

Imported cost push inflation as a result of inflation in other parts of the world.

A fall in the exchange rate: A reduction in the exchange rate will mean that more Sterling is required to purchase a given quantity of imports; the price of imports will rise. After a time-lag, retail prices will rise. Given that approximately 35% of the CPI basket of consumer goods and services are imports, the effect of a fall in the exchange rate is to raise the CPI. Imported raw materials are more expensive so costs of production will rise for those firms that import. Therefore, while a low exchange rate may be beneficial for exports, it has as a potentially inflationary effect on costs and prices // Research by the Bank of England has identified two phases through which a change in the exchange rate 'passes through' the economy.

1. In phase one, a change in the exchange rate affects import prices fairy quickly.

2. In phase two, changes in import prices work their way into retail prices. Phase two may take much longer, even up to 3 years to complete.

Deflation: causes

Deflation tends to occur when the economy’s capacity, as indicated by the position of the AS curve, grows at a faster rate than AD. Firms have to cut prices in order to stimulate sales and get rid of stocks.

Deflation can be triggered by an increase in supply. As business and consumer confidence in the economy declines, AD falls, resulting in recession.

Deflation

Macroeconomic indicators

Macroeconomic performance covers a wide range of indicators – summarised as:

• Real GDP Growth (short term and long term)

• Jobs (unemployment and employment rates)

• Prices e.g. as measured by the annual change in the consumer price index

• Trade balances and measures of competitiveness

• Productivity of labour and capita inputs

• Average standard of living e.g. measured by per capita GDP (PPP adjusted)

• Quality and accessibility of public services

The macroeconomic performance of any one nation is affected by events, policies and shocks in other countries. No economy is immune to what is happening in the global financial and economic system.

Macroeconomic performance is how well a country is doing in reaching important objectives or key targets of government policy.

Measuring Objectives

- Jobs – Unemployment levels

- Prices –are price rises under control?

- Trade – is the economy performing well in trading goods and services with other countries? Competitiveness

- Growth – how successful has the country been in achieving growth and in laying foundations for future expansion and development

- Development - the expansion of people’s freedom to live long, healthy and creative lives

- Efficiency - is the economy improving productivity so that more goods and services can be supplied at lower cost?

- Public services – NHS, Education, transport

- The environment – economic growth is sustainable in terms of environmental impact.

- Inequality of income and wealth - Distribution of income and wealth.

Market Failure

Definition of Market Failure This occurs when there is an inefficient allocation of resources in a free market. Market failure can occur due to a variety of reasons, such as monopoly (higher prices and less output), negative externalities (over-consumed) and public goods (usually not provided in a free market)

Key Terms in Market Failure

· Externalities: These occur when a third party is affected by the decisions and actions of others.

· Social benefit: the total benefit to society =

Private Marginal Benefit (PMB) + External Marginal Benefit (XMB)

· Social Cost: is the total cost to society =

Private Marginal Cost (PMC) + External Marginal Cost (XMC

· Social Efficiency: This occurs when resources are utilised in the most efficient way. This will occur at an output where social marginal cost (SMC) = Social Marginal Benefit. (SMB)

Market Failure: Types

1. Positive externalities –Goods/services which give benefit to a third party, e.g. education

2. Negative externalities –Goods/services which impose cost on a third party, e.g. smoking

3. Merit goods –People underestimate the benefit of good, e.g. education

4. Demerit goods –People underestimate the costs of good, e.g. smoking

5. Public Goods – Goods which are non-rival and non-excludable – e.g. police,

6. Monopoly Power – when a firm controls the market and can set higher prices.

7. Inequality – unfair distribution of resources in free market

8. Factor Immobility – E.g. geographical / occupational immobility

9. Agriculture – due to volatile prices and externalities.

10. Information failure – where there is a lack of information to make an informed choice.

11. Principal-agent problem – Two agents with different objectives and information asymmetries

Market Failure: Overcoming

- Tax on Negative Externalities – e.g. Petrol tax

- Carbon Tax e.g. tax on CO2 emissions

- Subsidy on positive externalities – why government may subsidies public transport

- Laws and Regulations – Simple and effective ways to regulate demerit goods, like a ban on smoking advertising.

- Buffer stocks – aim to stabilise prices

- Government failure – why government intervention may not always improve the situation

Market Failure

Monopoly

A pure monopoly is a single supplier in a market.

Formation of monopolies

Monopolies can form for a variety of reasons, including the following:

-

If a firm has exclusive ownership of a scarce resource, it has monopoly power over this resource and is the only firm that can exploit it.

-

Governments may grant a firm monopoly status, such as with the Post Office, in 2006, when the market was opened up to competition.

-

Producers may have patents over designs, or copyright over ideas, characters, images, sounds or names, giving them exclusive rights.

-

A monopoly could be created following the merger of two or more firms. Given that this will reduce competition, such mergers are subject to close regulation and may be prevented if the two firms gain a combined market share of 25% or more.

Monopoly: Key characteristics

-

Monopolies can maintain super-normal profits in the long run. Profits are maximised when MC = MR. The level of profit depends upon the degree of competition in the market, which for a pure monopoly is zero. At profit maximisation, MC = MR, and output is Q and price P. Given that price (AR) is above ATC at Q, supernormal profits are possible (area PABC).

-

With no close substitutes, the monopolist can derive super-normal profits, area PABC.

-

A monopolist with no substitutes would be able to derive the greatest monopoly power.

Natural Monopolies: Explanation

A natural monopoly is a distinct type of monopoly that may arise when there are extremely high fixed costs of distribution, such as exist when large-scale infrastructure is required to ensure supply. These costs are also sunk costs, and they prevent entry and exit.

In the case of natural monopolies, trying to increase competition by encouraging new entrants into the market creates a potential loss of efficiency. The efficiency loss to society would exist if the new entrant had to duplicate all the fixed factors - that is, the infrastructure.

It may be more efficient to allow only one firm to supply to the market because allowing competition would mean a wasteful duplication of resources.

Natural Monopolies: Economies of scale

With natural monopolies, economies of scale are very significant so that minimum efficient scale is not reached until the firm has become very large in relation to the total size of the market.

Minimum efficient scale (MES) is the lowest level of output at which all scale economies are exploited. If MES is only achieved when output is relatively high, it is likely that few firms will be able to compete in the market. When MES can only be achieved when one firm has exploited the majority of economies of scale available, then no more firms can enter the market.

Utility companies

Natural monopolies are common in markets for ‘essential services’ that require an expensive infrastructure to deliver the good or service, such as in the cases of water supply, electricity, and gas, and other industries known as public utilities.

Because there is the potential to exploit monopoly power, governments tend to nationalise or heavily regulate them.

Natural Monopolies: Regulators

If public utilities are privately owned, as in the UK, since privatisation during the 1980s, they usually have their own special regulator to ensure that they do not exploit their monopoly status. Examples of regulators include Ofgem, the energy regulator, and Ofcom, the telecoms and media regulator. Regulators can cap prices or the level of return gained.

Railways as a natural monopoly

Railways are often considered a typical example of a natural monopoly. The very high costs of laying track and building a network, as well as the costs of buying or leasing the trains, would prohibit, or deter, the entry of a competitor.

To society, the costs associated with building and running a rival network would be wasteful.

Natural Monopolies: Avoiding wasteful duplication

The best way to ensure competition, avoiding duplication, is to allow new train operators to use the existing track; hence, competition has been introduced, without duplication of costs. This is called opening-up the infrastructure. This approach is frequently adopted to deal with the problem of privatising natural monopolies and encouraging more competition, such as:

-

Telecoms, the network is provided by BT

-

Gas, the network is provided by National Grid (previously Transco)

With a natural monopoly, ATC keep falling because of continuous economies of scale. In this case, MC is always below ATC over the whole range of possible output.

Natural Monopolies: Profit

In order to maximise profits the natural monopolist would charge Q, and make super-normal profits. If unregulated, and privately owned, the profits are likely to be excessive. In addition, the natural monopolist is likely to be allocatively and productively inefficient.

Natural Monopolies: Losses

To achieve allocative efficiency, the regulator will have to impose an excessive price-cap (at P1). The output needed to be allocatively efficient, at Q1, is so high that the natural monopolist is forced to make losses, given that ATC is above AR at Q1. Allocative efficiency is achieved when price (AR) = marginal cost (MC), at A, but at this price, the natural monopolist makes a loss.

A public utility’s losses could be dealt with in a number of ways, including:

-

Subsidies from the government.

-

Price discrimination, whereby additional revenue can be derived by splitting the market into two or more sub-groups, and charging different prices to each sub-group.

Oligopoly: Defining and measuring

An oligopoly is a market structure in which a few firms dominate. It is said to be highly concentrated. Although only a few firms dominate, it is possible that many small firms may also operate in the market. For example, major airlines like British Airways (BA) and Air France operate their routes with only a few close competitors, but there are also many small airlines catering for the holidaymaker or offering specialist services.

Concentration ratios

Oligopolies may be identified using concentration ratios, which measure the proportion of total market share controlled by a given number of firms. When there is a high concentration ratio in an industry, economists tend to identify the industry as an oligopoly.

Oligopoly: Key characteristics

Interdependence: Firms that are interdependent cannot act independently of each other. Oligopoly firms must take the potential reaction of its closest rivals into account when making its own decisions. An understanding of game theory and the Prisoner’s Dilemma helps appreciate the concept of interdependence.

Strategy: Strategy is extremely important to firms that are interdependent. Because firms cannot act independently, they must anticipate the likely response of a rival to any given change in their price, or their non-price activity. Oligopolists have to make critical strategic decisions, such as:

· Whether to compete with rivals, or collude with them.

· Whether to raise or lower price, or keep price constant.

· Whether to be the first firm to implement a new strategy, or whether to wait and see what rivals do. The advantages of ‘going first’ or ‘going second’ are respectively called 1st and 2nd-mover advantage. Sometimes it pays to go first because a firm can generate head-start profits. 2nd mover advantage occurs when it pays to wait and see what new strategies are launched by rivals, and then try to improve on them or find ways to undermine them.

Barriers to entry: Oligopolies and monopolies frequently maintain their position of dominance in a market might because it is too costly or difficult for potential rivals to enter the market. These hurdles are called barriers to entry and the incumbent can erect them deliberately, or they can exploit natural barriers that exist.

Oligopoly: Natural Barriers

Economies of large scale production: If a market has significant economies of scale that have already been exploited by the incumbents, new entrants are deterred.

Ownership or control of a key scarce resource: Owning scarce resources that other firms would like to use creates a considerable barrier to entry, such as an airline controlling access to an airport.

High set-up costs: High set-up costs deter initial market entry, because they increase break-even output, and delay the possibility of making profits. Many of these costs are sunk costs, which are costs that cannot be recovered when a firm leaves a market, and include marketing and advertising costs and other fixed costs.

High R&D costs: Spending money on Research and Development (R & D) is often a signal to potential entrants that the firm has large financial reserves. In order to compete, new entrants will have to match, or exceed, this level of spending in order to compete in the future. This deters entry, and is widely found in oligopolistic markets such as pharmaceuticals and the chemical industry.

Oligopoly: Artificial barriers

Predatory pricing: firm deliberately tries to push prices low to force rivals out the market.

Limit pricing: means the incumbent firm sets a low price, and a high output, so that entrants cannot make a profit at that price. Selling at a price just below the ATC of potential entrants.

Superior knowledge: An incumbent may, over time, have built up a superior level of knowledge of the market, its customers, and its production costs.

Predatory acquisition: involves taking-over a potential rival by purchasing sufficient shares to gain a controlling interest, or by a complete buy-out. Regulators may prevent this.

Advertising: is another sunk cost.

A strong brand: creates loyalty, ‘locks in’ existing customers, and deters entry.

Loyalty schemes: Schemes such as Tesco’s Club Card.

Exclusive contracts, patents and licences: These make entry difficult as they favour existing firms who have won the contracts or own the licenses.

Vertical integration: can ‘tie up’ the supply chain and make life tough for potential entrants, such as Sony.

Oligopoly: Collusion

Another key feature of oligopolistic markets is that firms may attempt to collude, rather than compete. If colluding, participants act like a monopoly and can enjoy the benefits of higher profits over the long term.

Types of collusion

Overt: Overt collusion occurs when there is no attempt to hide agreements, such as the when firms form trade associations like the Association of Petrol Retailers.

Covert: Covert collusion occurs when firms try to hide the results of their collusion, usually to avoid detection by regulators, such as when fixing prices.

Tacit: Tacit collusion arises when firms act together, called acting in concert, but where there is no formal or even informal agreement. For example, it may be accepted that a particular firm is the price leader in an industry, and other firms simply follow the lead of this firm. All firms may ‘understand’ this, but no agreement or record exists to prove it. If firms do collude, and their behaviour can be proven to result in reduced competition, they are likely to be subject to regulation. In many cases, tacit collusion is difficult or impossible to prove, though regulators are becoming increasingly sophisticated in developing new methods of detection.

Oligopoly: Competitive

Oligopolists prefer non-price competition in order to avoid price wars.

Oligopolies may pursue the following pricing strategies:

-

Predatory pricing to force rivals out of the market. This means keeping price artificially low, and often below the full cost of production.

-

They may also operate a limit-pricing strategy to deter entrants.

-

Oligopolists may collude with rivals and raise price together.

-

Cost-plus pricing is a straightforward pricing method, where a firm sets a price by calculating average production costs and then adding a fixed mark-up to achieve a desired profit level.

Oligopoly: Kinked demand curve

The reaction of rivals to a price change depends on whether price is raised or lowered. The elasticity of demand, & the gradient of the demand curve, will be different. The demand curve will be kinked, at the current price.

Even when there is a large rise in marginal cost, price tends to stick close to its original, given the high price elasticity of demand for any price rise.

At price P, and output Q, revenue will be maximised.

Oligopoly:

Maximising profits: Profits will always be maximised when MC = MR, and so long as MC cuts MR in its vertical portion, then profit maximisation is still at P. Even when MC moves out of the vertical portion, the effect on price is minimal, and consumers will not gain the benefit of any cost reduction.

A game theory approach to price stickiness: Pricing strategies can also be looked at in terms of game theory; that is in terms of strategies and payoffs. There are three possible price strategies, with different pay-offs and risks:

1. Raise price

2. Lower price

3. Keep price constant

Although keeping price constant will not lead to the single best outcome, it may be the least risky strategy for an oligopolist.

Oligopoly: The Prisoner's Dilemma

The Prisoner’s Dilemma

Game theory also predicts that: There is a tendency for cartels to form because co-operation is likely to be highly rewarding. Co-operation reduces the uncertainty associated with the mutual interdependence of rivals in an oligopolistic market. While cartels are ‘unlawful’ in most countries, they may still operate, with members concealing their unlawful behaviour.

Cartels are designed to protect the interests of members, and the interests of consumers may suffer because of:

1. Higher prices or hidden prices, such as the hidden charges in credit card transactions

2. Lower output

3. Restricted choice or other limiting conditions associated with the transaction

A classic game called the Prisoner's Dilemma is often used to demonstrate the interdependence of oligopolists.

Oligopoly: Disadvantages

· High concentration reduces consumer choice.

· Cartel-like behaviour reduces competition and can lead to higher prices and reduced output.

· Given the lack of competition, oligopolists may be free to engage in the manipulation of consumer decision making.

· Firms can be prevented from entering a market because of deliberate barriers to entry.

· There is a potential loss of economic welfare.

· Oligopolists may be allocatively and productively inefficient. At profit maximising equilibrium, P, price is above MC, and output, Q, is less than the productively efficient output, Q1, at point A.

Oligopoly: Disadvantages diagram

Oligopoly: Advantages

1. Oligopolies may adopt a highly competitive strategy, in which case they can generate similar benefits to more competitive market structures, such as lower prices. Even though there are a few firms, making the market uncompetitive, their behaviour may be highly competitive.

2. Oligopolists may be dynamically efficient in terms of innovation and new product and process development. The super-normal profits they generate may be used to innovate, in which case the consumer may gain.

3. Price stability may bring advantages to consumers and the macro-economy because it helps consumers plan ahead and stabilises their expenditure, which may help stabilise the trade cycle.

Monopolistic competition

The model of monopolistic competition describes a common market structure in which firms have many competitors, but each one sells a slightly different product.

Characteristics

Monopolistically competitive markets exhibit the following characteristics:

-

Each firm makes independent decisions about price and output, based on its product, its market, and its costs of production.

-

Knowledge is widely spread between participants, but it is unlikely to be perfect. For example, diners can review all the menus available from restaurants in a town, before they make their choice. Once inside the restaurant, they can view the menu again, before ordering. However, they cannot fully appreciate the restaurant or the meal until after they have dined.

-

The entrepreneur has a more significant role than in firms that are perfectly competitive because of the increased risks associated with decision making.

-

There is freedom to enter or leave the market, as there are no major barriers to entry or exit.

Monopolistic competition: Characteristics

A central feature of monopolistic competition is that products are differentiated. There are four main types of differentiation:

-

Physical product differentiation, where firms use size, design, colour, shape, performance, and features to make their products different. For example, consumer electronics can easily be physically differentiated.

-

Marketing differentiation, where firms try to differentiate their product by distinctive packaging and other promotional techniques. For example, breakfast cereals can easily be differentiated through packaging.

-

Human capital differentiation, where the firm creates differences through the skill of its employees, the level of training received, distinctive uniforms, and so on.

-

Differentiation through distribution, including distribution via mail order or through internet shopping, such as Amazon.com, which differentiates itself from traditional bookstores by selling online.

Monopolistic competition: Characteristics

-

Firms are price makers and are faced with a downward sloping demand curve. Because each firm makes a unique product, it can charge a higher or lower price than its rivals. The firm can set its own price and does not have to ‘take' it from the industry as a whole, though the industry price may be a guideline, or becomes a constraint. This also means that the demand curve will slope downwards.

-

Firms operating under monopolistic competition usually have to engage in advertising. Firms are often in fierce competition with other (local) firms offering a similar product or service, and may need to advertise on a local basis, to let customers know their differences. Common methods of advertising for these firms are through local press and radio, local cinema, posters, leaflets and special promotions.

-

Monopolistically competitive firms are assumed to be profit maximisers because firms tend to be small with entrepreneurs actively involved in managing the business.

-

There are usually a large numbers of independent firms competing in the market.

Monopolistic competition

Equilibrium under monopolistic competition: In the short run supernormal profits are possible, but in the long run new firms are attracted into the industry, because of low barriers to entry, good knowledge and an opportunity to differentiate.

Monopolistic competition in the short run: At profit maximisation, MC=MR, and output is Q and price P. Given that price (AR) is above ATC at Q, supernormal profits are possible (area PABC). As new firms enter the market, demand for the existing firm’s products becomes more elastic and the demand curve shifts to the left, driving down price. Eventually, all super-normal profits are eroded away.

Monopolistic competition: Long Run

Super-normal profits attract in new entrants, which shifts the demand curve for existing firm to the left. New entrants continue until only normal profit is available. At this point, firms have reached their long run equilibrium.

Clearly, the firm benefits most when it is in its short run and will try to stay in the short run by innovating, and further product differentiation.

Monopolistic competition: Evaluation

The advantages of monopolistic competition

1. There are no significant barriers to entry; therefore markets are relatively contestable.

2. Differentiation creates diversity, choice and utility. E.g, Restaurants in small towns.

3. The market is more efficient than monopoly but less efficient than perfect competition - less allocatively and less productively efficient. However, they may be dynamically efficient, innovative in terms of new production processes or new products. For example, retailers often constantly have to develop new ways to attract and retain local custom.

The disadvantages of monopolistic competition

1. Some differentiation does not create utility but generates unnecessary waste, such as excess packaging. Advertising may also be considered wasteful, though most is informative rather than persuasive.

2. As the diagram illustrates, assuming profit maximisation, there is allocative inefficiency in both the long and short run. This is because price is above marginal cost in both cases. In the long run the firm is less allocatively inefficient, but it is still inefficient.

Monopolistic competition: Inefficiencies

The firm is allocatively and productively inefficient in both the long and short run.

There is a tendency for excess capacity because firms can never fully exploit their fixed factors because mass production is difficult. This means they are productively inefficient in both the long and short run. However, this is may be outweighed by the advantages of diversity and choice. As an economic model of competition, monopolistic competition is more realistic than perfect competition.

Perfect Competition

A perfectly competitive market is a hypothetical market where competition is at its greatest possible level. Neo-classical economists argued that perfect competition would produce the best possible outcomes for consumers, and society.

Key characteristics:

1. There is perfect knowledge, with no information failure or time lags in the flow of information.

2. Producers and consumers have perfect knowledge, they make rational decisions to maximise their self interest - consumers look to maximise their utility, and producers look to maximise their profits.

3. There are no barriers to entry into or exit out of the market.

4. Firms produce homogeneous, identical, units of output that are not branded.

5. Each unit of input, such as units of labour, are also homogeneous.

6. No single firm can influence the market price, or market conditions.

7. There are very many firms in the market. This is a result of having no barriers to entry.

8. There is no need for government regulation, except to make markets more competitive.

9. There are assumed to be no externalities.

10. Firms can only make normal profits in the long run, although they can make abnormal (super-normal) profits in the short run.

Perfect Competition: The firm as a price taker

The single firm takes its price from the industry, and is, consequently, referred to as a price taker. The industry is composed of all firms in the industry and the market price is where market demand is equal to market supply. Each single firm must charge this price and cannot diverge from it.

Perfect Competition: Equilibrium

In the short run: firms can make super-normal profits or losses.

Perfect Competition: Long Run

Firms are attracted into the industry if the incumbent firms are making supernormal profits. This is because there are no barriers to entry and because there is perfect knowledge. The effect of this entry into the industry is to shift the industry supply curve to the right, which drives down price until the point where all super-normal profits are exhausted. If firms are making losses, they will leave the market as there are no exit barriers, and this will shift the industry supply to the left, which raises price and enables those left in the market to derive normal profits.

In the long run: The super-normal profit derived by the firm in the short run acts as an incentive for new firms to enter the market, which increases industry supply and market price falls for all firms until only normal profit is made.

Perfect Competition: Evaluation Benefits

1. Because there is perfect knowledge, there is no information failure.

2. Existing firms cannot derive any monopoly power.

3. Only normal profits made, so producers just cover their opportunity cost.

4. There is no need to spend money on advertising, because there is perfect knowledge and firms can sell all they can produce. No branding, hard to advertise.

5. There is maximum possible:

6. There is maximum allocative and productive efficiency:

a. Equilibrium will occur where P = MC, hence allocative efficiency.

b. In the long run equilibrium will occur at output where MC = ATC, which is productive efficiency.

7. There is also maximum choice for consumers.

Perfect Competition

Perfect Competition: Realistic?

Very few markets or industries in the real world are perfectly competitive. For example, how homogeneous is the output of real firms, given that even the smallest of firms working in manufacturing or services try to differentiate their product.

The assumption that producers and consumers act rationally is questioned by behavioural economists, who have become increasingly influential over the last decade. Numerous experiments have demonstrated that decision making often falls well short of what could be described as perfectly rational. Decision making can be biased and subject to rule of thumb ‘guidance’ when consumers and producers are faced with complex situations.

Although unrealistic, it is still a useful model in two respects. Firstly, many primary and commodity markets, such as coffee and tea, exhibit many of the characteristics of perfect competition, such as the number of individual producers that exist, and their inability to influence market price. Secondly, for other markets in manufacturing and services, the model is a useful yardstick by which economists and regulators can evaluate levels of competition that exist in real markets.

Consumer surplus

Consumer surplus is derived whenever the price a consumer actually pays is less than they are prepared to pay.

Producer surplus

Producer surplus is the additional private benefit to producers, in terms of profit, gained when the price they receive in the market is more than the minimum they would be prepared to supply for.

Economic Welfare

Economic welfare is the total benefit available to society from an economic transaction or situation.

Productive efficiency

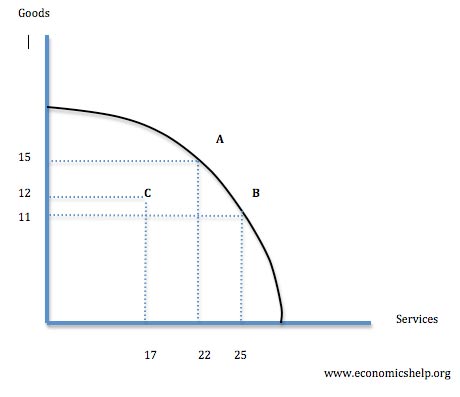

Productive efficiency is concerned with producing goods and services with the optimal combination of inputs to produce maximum output for the minimum cost. // To be productively efficient means the economy must be producing on its production possibility frontier

- Points A and B are productively efficient.

- Point C is inefficient because you could produce more goods or services with no opportunity cost

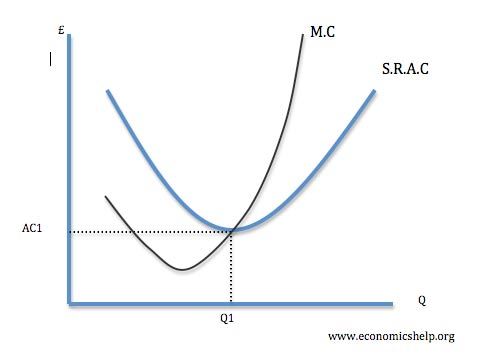

Productive efficiency

A firm is said to be productively efficient when it is producing at the lowest point on the average cost curve (where Marginal cost meets average cost).

A firm is technically efficient when it combines the optimal combination of labour and capital to produce a good. An economy can be productively efficient but have very poor allocative efficiency.

Allocative efficiency is concerned with the optimal distribution of resources.

Related discussions on The Student Room

- Economic's AS + A2 Notes (ALL BOARDS) »

- Should i do A-Level Geography? »

- Best economics revision guides? »

- A-level Exam Discussions 2024 »

- A level math in 1 year »

- Using Old Spec to Revise New Spec (Maths, Chemistry, Biology) A level »

- GCSE’s »

- AQA as level economics 2015 specimen paper 2 »

- A2 Further maths »

- Welcome to the A level forum! »

Comments

No comments have yet been made