Balance sheets and income statements

- Created by: charliedee

- Created on: 29-05-17 11:19

58.1 Introduction

For stakeholders, published accounts allow an analyst to find out:

- The amount of cash or near cash the company holds in its bank accounts.

- How that cash total compares with its short-term liabilities.

- How much of all the firm's long-term capital is in the form of debt - and therefore needs to be serviced with interest payments and eventually must be repayed.

- How profitable the business is.

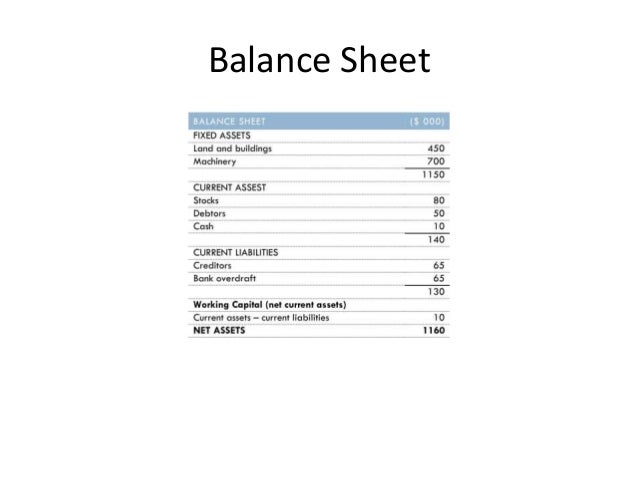

58.2 Balance sheets

The balance sheet provides a summary of the assets and liabilities of a business. It is a snapshot of those assets at a particular moment in time.

The balance sheet shows where a business has obtained its finances - its liabilities. It also lists the assets purchased with these funds. Therefore, the balance sheet shows what the business owns and what it owes. For bankers this is of vital importance when deciding whether or not to:

- invest in a business

- lend it some money

- buy the organisation outright.

58.2 Balance sheets

Types of asset

Long-term (non-current) assets:

- land and buildings

- plant/machinery/equipment

- vehicles

- patents/copyright

Current assets:

- Inventories

- Recievables - sums owed by customers who have bought items on credit

- Cash - all forms of bank account that can easily be accesse, for example the balance on a current account.

58.2 Balance sheets

Capital on the balance sheet

Companies have three main sources of long term capitla: shareholders, bank loans and reinvested profits (reserves). Loan capital carries interest charges that must be repaid, as must the loan itself. Share capital and reserves are both owed to the shareholders, but they do not have to be repaid. Therefore they are treated seperately. Share capital and reserves are known as total equity.

58.3 Assessing financial performance using a balan

Financial performance really means the level of success achieved by the business. Typically this is measured by profit - perhaps the % growth in profit compared with the previous year. This can be found in a firm's income statement. The balance sheet gives a vital clue to a company's real performance over time through the item known as reserves. This shows the accumulated, retained profit ever since the business started trading.

58.4 Income statements

The income statement is a historical record of the trading of a business over a specific period (normally one year). It shows the profit or loss made by the business – which is the difference between the firm's total income and its total costs.

For many stakehlders, profit is a major criterion by which to judge the success of a business:

- shareholders are an obvious example of those assessing profitability

- government agencies such as the tax authorities require data on profits or losses in order to be able to calculate the liability of a business to corporation tax

- suppliers to a business also need to know the financial position of the companies they trade with, in order to establish their reliability, stability and creditworthiness

- potential shareholders and bankers will also want to assess the financial position of the company before comitting their funds to the business.

58.4 Income statements

The uses of income statements:

- to measure the success of a business compared with previous years or other businesses

- to assess actual performance compared with expectations

- to help obtain loans from banks or other lending institutions (creditors want proof that the business is capable of repaying any loans)

- to enable owners and managers to plan ahead; for example; for future investment in the company.

58.5 How an income statement shows a profit or los

The income statement comprises four main stages.

- First, gross profit is calculated. This is the difference between the income and the cost of the goods that have been sold. The latter is normally expressed simply as cost of sales.

- Second, operating profit is calculated. This is done be deducting the main types of overhead, such as distribution costs and administration costs.

- Next, profit before taxation is calculated, which is arrived at by the inclusion of interest recieved by the business and interest paid by it. These are normally shown together as a net figure labelled financing costs.

- The final stage of the income statement is to calculate profit after taxation. This is arrived at by deducting the amount of tax payable for the year and shows the net amount that has been earned for the shareholders.

Calculating gross profit:

This element of the income statement shows how much revenue has been earned from sales less the cost of goods sold. Revenue - cost of goods sold = gross profit.

When calculating revenue, sales tax such as VAT are excluded as they are paid directly to the tax authorities.

58.5 How an income statement shows a profit or los

Calculating operating profit.

The next stage of the income statement sets out the net operating profit, or net operating loss, made by the business. The gross profit figure is necessary to calculate operating profit so this naturally follows on from calculating gross profit.

An important relationship to remember is that operating profit equals gross profit less expenditure.

Expenses: Are payments for something that is of immediate use to the business. These payments include cash expenditures on labour and fuel, as well as non-cash items such as depreciation.

Overheads include:

- wages and salaries

- rent and rates

- heating, lighting and insurance

- distribution costs.

58.5 How an income statement shows a profit or los

Operating costs

Deducting expenses from gross profit leads to operating profit. Most firms regard this as the key test of their trading performance for the year. At the very least a firm would want their operating profit to be:

- up by at least the rate of inflation from the previous year

- as high a % of capital employed as that achieved by rival companies

- high enough to reinvest in the future of the business while still paying satisfactory dividends to shareholders.

Financing costs

Can add to or take away from the operating profit of a business. Most companies have relatively high borrowings and therefore can have to pay out a large proportion of their profit in interest charges.

58.5 How an income statement shows a profit or los

Profit before and after taxation

All businesses pay corporation tax on their profits. Once tax has been deducted, the final figure on the income statement is profit after taxation for the year. This figure is also known as the company's earnings.

Using profits

Earnings can be used in two main ways: it can either be distributed or retained. Usually businesses retain some profits and distribute the remainder. The balance between these two uses is influenced by a number of factors.

- Distributed profit - the company directors will decide on the amount to be paid out to shareholders in the form of dividends; if the shareholders are unhappy with the sum paid out, they can vote against the dividend at the annual general meeting.

- Retained profit - any prudent owner or manager of a business will use some of the profit made by the business to reinvest in the business for the future.

58.6 Assessing financial performance using an inco

Plcs are required by law to publish their accounts. This means that they are available for scrutiny not only by the owners, potential investors and bankers, but also by competitors. When a company draws up its income statement for external publication it will include as little information as possible. Plcs usually supply no more detail than they have to.

Related discussions on The Student Room

- Help with BA accounting and finance modules »

- Accounting ratios help »

- AQA A Level Business Paper 2 (7132/2) - 7th June 2023 [Exam Chat] »

- Digital Marketing Student needing some advice! »

- A-level Business Paper 1 predictions 2022 »

- Could someone please help with some feedback »

- Could you give me feedback on this please »

- personal statement help »

- accounting »

- Coping with Financial Stress: Finding Balance Through Part-Time Jobs at Herts »

Comments

No comments have yet been made